does kansas have estate tax

In this detailed guide of the inheritance laws in the Sunflower State we break down intestate succession probate taxes what makes a will valid and more. Is property tax deductible in Kansas.

Gift And Estate Exclusion Amounts Resource Shark Blog Https Blog Resourceshark Com Gift An Last Will And Testament Estate Planning Attorney Estate Planning

Many other states use a combination of all three.

. Delaware repealed its tax as of January 1 2018. What is capital gains tax on real estate in Kansas. According to the Kansas Income Tax Instructions for Armed Forces Personnel the active duty pay of a military member is taxable only in the state of legal residence no matter where the servicemember is stationed.

Kansas does not collect an estate tax or an inheritance tax. It is one of 38 states in the country that does not levy a tax on estates. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Do I have to pay capital gains tax on my house when I sell it. Kansas is one of the thirty-eight states that does not collect estate tax. Mortgage Calculator Rent vs Buy.

Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9. Does Kansas have state tax for military. States That Have Repealed Their Estate Taxes.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. It is the responsibility of the Kansas county appraiser to classify all taxable and exempt real and personal property. State laws are constantly changing but here is a list of the currently listed states that are collecting estate tax or inheritance tax at a local level.

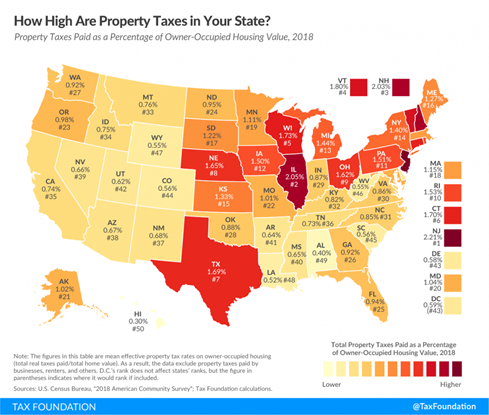

The states average effective property tax rate annual property taxes paid as a percentage of home value is 137. The median home value in the state is slightly below the example above but at 139200 your property tax bill would still come out to about 1952 for the year. That means the annual tax on a 194000 home is 2713 per year.

In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Does kansas have inheritance tax.

Generally the estate tax in Kansas was set to. Some places call them a real estate transfer tax some use document transfer fee and some even call it a stamp tax. There is a federal estate tax that may apply.

State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma. In most states it is set at a rate for every 500 of property value. There is no estate tax in Kansas.

Does Kansas have high property taxes. Kansas Estate Tax Kansas maintained an estate tax similar to the federal estate tax through 2010. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford.

Value does not factor into Kansas taxes nor do other factors. In Kansas it used to be called a mortgage registration tax which was complex and often hard to calculate and has recently been replaced. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

Under this section property subject to taxation is divided into two. You can also claim the state and local sales tax amounts you paid for big-ticket items. Kansas Property Taxes While the typical homeowner in Kansas pays just 2235 annually in real estate taxes property tax rates are fairly highThe states average effective property tax rate annual property taxes paid as a percentage of home value is 137.

But this can vary greatly from area to area in Kansas. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Does kansas have an estate or inheritance tax.

Taxes are assessed each year and must be based on the value of personal property. However you are able to deduct personal property tax on the vehicle. Seven states have repealed their estate taxes since 2010.

You may also need to file. Kansas has a property tax rate 140. Maryland is the only state to impose both.

The federal estate tax applies to all estates in the United States of America that have a valued of slightly over eleven million dollars and are owned by a single person. Property is cheap in Kansas with an average house price of 159400 so your annual liability is at least kept to a median of 2235. Impose estate taxes and six impose inheritance taxes.

In Kansas it is set at 026 for every 100 or 026. The federal estate tax applies to all estates in the United States of America that have a valued of slightly over eleven million dollars and are owned by a single person. Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570.

Kansas does not have an estate or inheritance tax. If you want professional guidance for your estate plan SmartAssets free financial. Kansas Property Taxes While the typical homeowner in Kansas pays just 2235 annually in real estate taxes property tax rates are fairly high.

The state of Kansas does not assess taxes based on value. Another item you may enter is sales tax. Capital gains in Kansas are taxed as regular income.

Vehicle is eligible for a deduction from ell tax on the vehicle. Twelve states and Washington DC. 79-1459 Classification for the purposes of ad valorem taxation is delineated in Article 11 Section 1 of the Kansas Constitution.

Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. These two states are maryland and new jersey.

With a property tax rate of 137compared to a national average of 107you stand to be hit with a hefty property tax bill every year. However if you are inheriting property from another state that state may have an estate tax that applies. Kansas is tough on homeowners.

The state sales tax rate is 65. Kansas is one of the thirty-eight states that does not collect estate tax. Does Kansas tax capital gains.

If you are a nonresident of Kansas stationed in Kansas your active duty pay is not taxable.

We Solve Tax Problems Debt Relief Programs Tax Debt Payroll Taxes

Do You Know The Tax Deductions When Selling Your Home See What You Can Deduct When Selling A House Including A Key Real E Tax Deductions Deduction Estate Tax

Kansas Estate Tax Everything You Need To Know Smartasset

Pin By Tina On Irs In 2022 Irs Taxes Capital Gains Tax Tax Brackets

Kansas Estate Tax Everything You Need To Know Smartasset

Those Who Have A Better Grasp Of Tax Technicalities And Opportunities For Economic Growth Will Always View Estat Estate Planning Florida Real Estate Estate Tax

Feb11 Gardner Table 1 Investing Financial Financial Planning

These 7 U S States Have No Income Tax The Motley Fool Income Tax Map Amazing Maps

Gamblers Love To Use Casino Win Loss Statements Because It Is Easy Just Report The Amounts From The Casino Win Loss Statements No Mus Casino Slot Tournaments

Kansas Estate Tax Everything You Need To Know Smartasset

Pin On Finances Save Money Today

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Pin On Kansas City Estate Planning Attorney

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Which Counties Pay The Most Taxes In Kansas You Ve Probably Guessed Correctly Wichita Business Journal

Kiplinger Tax Map Retirement Tax Income Tax

7 Easy Payroll Remittance Form Sample Payroll Payroll Taxes Form

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is A Homestead Exemption Protecting The Value Of Your Home Homesteading What Is Homestead Property Tax